Mekong Delta catfish industry under intense financial pressure

By Peter Starr*With the Vietnamese economy overheating earlier this year, the aquaculture bubble has burst. But catfish exports are still booming.

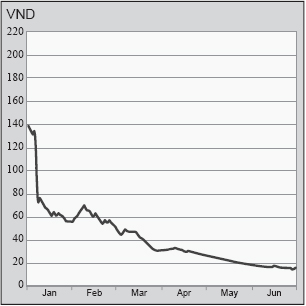

VN Index

Six months to June 30, 2008

Source: Vietcombank Securities

With the value of shares listed on the Ho Chi Minh Stock Exchange losing more than half their value during the first half of 2008, the aquaculture industry has emerged as one of the weakest sectors of the overall Vietnamese equity market. As monetary authorities raised interest rates to curb inflation, the market capitalisation of five catfish processors in the Mekong Delta dropped by 72% in the six months to June (see table below). Leading catfish producer An Giang Fisheries (Agifish), a major exporter which has been listed for six years, lost two thirds of its value. So did Cuu Long Fish (CL-Fish Corp), a rival catfish processor from An Giang province which listed its shares only last year (see charts below).

Another relative newcomer to the market, Ben Tre Forestry and Aquaculture (Faquimex), suffered an even steeper decline. Faquimex, which processes both catfish and shrimp, made its trading debut on January 14 this year. By the end of June, its share price had lost three-quarters of its value and was barely trading above par. The heaviest losses were suffered by Nam Viet Corp (Navico), the biggest catfish exporter. Navico’s share price fell almost 90%. In the space of six months, it went from being the biggest to the smallest of the five processors in terms of market capitalisation. Losses were less acute for Ben Tre Aquaproduct (Aquatex Bentre). Its share price dropped 59%, broadly in line with the 57% decline in the VN Index (see chart above).

The upshot is that investors wiped 3.1 trillion dong (US$187 million) off the value of these five companies during the first half of the year. As a result, their combined market capitalisation fell from 4.3 trillion dong ($260 million) at the end of 2007 to 1.2 trillion dong ($73 million) at the end of June. The impact on actual business conditions has been mixed. In January for example, CL-Fish announced plans to contribute 32.4 billion dong ($2 million) towards the establishment of a joint venture capitalised at 90 billion dong ($5.5 million), giving it a stake of 36%. In April, it decided to go ahead with the venture with Thai Son Co and three foreign partners—Singapore’s Inter-Ocean Foods, Malaysia’s Piau Kee Holdings and a Saudi Arabian partner. However, the company also announced that it had postponed the construction of a joint-venture processing plant targeting export markets in Russia, Singapore and Eastern Europe. At the same time, Faquimex postponed an additional share issue to raise 105 billion dong ($6.4 million).

Selected catfish processors

Listed on the Ho Chi Minh Stock Exchange

| Code | Name | Province | Est | List | Staff | Ownership (%) | Market Cap (VND blk) | ||

| State | Foreign | Dec 28 2008 | Jun 30 2008 | ||||||

| ABT | Aquatex Bentre |

Ben Tre |

NA | 2006 | NA | NA | 51.8 | 729 | 297 |

| ACL | CL-Fish |

An Giang |

2003 | 2007 | 1223 | NA | NA | 761 | 230 |

| AGF | Agifish |

An Giang |

2001 | 2002 | 2561 | 8.2 | 47.0 | 1060 | 390 |

| FBT | Faquimex |

Ben Tre |

NA | 2008 | NA | 32.8 | 8.8 | *630 | 155 |

| NAV | Navico |

An Giang |

2001 | 2006 | 853 | 30.0 | NA | 1104 | 127 |

| 4284 | 1199 | ||||||||

Despite sharp declines in values, foreign investors remain among the key shareholders in at least two companies, holding 47% of Agifish and 52% of Aquatex Bentre in August. These included a fund listed on the Irish Stock Exchange and several funds operated by Dragon Capital, a foreign portfolio fund manager with offices in Viet Nam, Britain and New Zealand.

Share prices

First Half, 2008

|

Company

|

Dec 28, 2007 Closing Price (VND) |

Jun 30, 2008 Closing Price (VND) |

Change (%) |

Aquatex Bentre |

90,000 | 36,600 | - 59.3 |

CL-Fish |

84,500 | 25,600 | - 69.7 |

Agifish |

82,400 | 30,300 | - 63.3 |

Faquimex |

*42,000 |

10,300 | - 75.5 |

Faquim |

138,000 | 15,900 | - 88.5 |

|

VN Index

|

927.02 | 399.40 | - 56.9 |

Source: Vietcombank Securities * Jan 14

Government and central bank intervene

According to Nguyen Hoang Vu, a former marketing manager with

Roussel Viet Nam who now runs his own consulting firm, the dollar's

recent appreciation against the dong and rising inflation caused

considerable difficulties among all stakeholders. "The situation

in early 2008 was an alert to the industry," Vu wrote in the

May-June edition of Aqua Culture Asia-Pacific

magazine. "Farmers with banks loans had to pay higher interest

rates while processing plants could not sell (dollars) to get

Vietnamese dong in order to purchase raw materials".

With tighter credit conditions creating supply bottle-necks, Deputy Prime Minister Hoang Trung Hao instructed banks in June to provide loans to processors to buy an estimated 300,000 tonnes of catfish over the next three months. According to Sai Gon Giai Phong, the party newspaper in Ho Chi Minh City, processors in An Giang province alone needed 2.2 trillion dong ($133 million) to maintain operations until the end of the year. At the same time, State Bank of Viet Nam Governor Nguyen Van Giau reportedly indicated that priority commercial bank lending would be directed towards the catfish sector as a key export industry.

Results and forecasts

Based on annual meeting resolutions

Company |

Sales (VND bln) | Net Profite (VND bln) |

||

| 2007 (actual) | 2008 (forecast) | 2007 (actual) | 2008 (forecast) | |

Aquatex Bentre |

427 | 500 | 39 | 40 |

CL-Fish |

538 | 640 | 56 | 60 |

Agifish |

1,246 |

1,400 | 40 | NA |

Faquimex |

366 | 727 | 16 | 37 |

Navico |

NA | NA | NA | NA |

Source: Vietcombank Securities * Jan 14

With inflation rising to 25% during the first half of the year, feed traders and farmers were also reported to be suffering. Sai Gon Giai Phong reported that feed traders had stopped accepting instalment payments from farmers and that some buyers were taking advantage of the situation to squeeze farmers. Agifish indicated as much in its first-quarter earnings statement released in late May. Although sales in the March quarter declined 5.7% from the December quarter, earnings more than doubled to 5.3 billion dong ($0.3 million) in the same period. Agifish attributed the higher, albeit modest, earnings to controls over input costs and management expenses in addition to lower

Agifish

share price (AGF) |

Cuu

Long Fish share price (ACL) |

|

Source: Vietcombank Securities |

Source: Vietcombank Securities |

|

Faquimex share

price (FBT) |

Aquatex Ben Tre

share price (ABT) |

|

Source: Vietcombank Securities |

Source: Vietcombank Securities |

Navico share price

(NAV)

Six months to June 30, 2008

Source: Vietcombank Securities

catfish prices. According to the Viet Nam Association of Seafood Exporters and Producers (VASEP), average export prices for catfish were $2.33 per kilogram in the five months to May, down 18% from the same period in 2007. Navico blamed falling export prices and rising production costs for its lower first-half earnings. In August, Navico said its pre-tax profit fell 19% from a year earlier to 164 billion dong ($9.9 million) in the six months to June.

Exports keep booming

The Vietnamese catfish export boom meanwhile showed no signs

of contracting during the first five months of this year. The

value of exports of Sutchi river catfish (Pangasianodon

hypophthalmus) and Bocourt’s catfish (Pangasius

bocourti) leapt 31% from a year earlier to $487 million

in the five months to May. According to VASEP, export volumes

jumped 48% to over 209,000 tonnes in the same period. In terms

of value, Russia was the biggest single market for these two

species, known as ca tra and ca basa

in Vietnamese. Russia accounted for more than 12% of all exports

followed Spain with more than 10% and the Netherlands and Germany

with about 8% each. Ukraine and the United States each accounted

for about 6% of exports and were followed by Mexico (4%), Hong

Kong and Australia (3% each) and Thailand and Singapore (2%

each).

During the five-month period, Navico was the leading exporter with shipments of $81 million. Among the other listed companies, Agifish ranked fourth with $20 million, while CL Fish was seventh with $15 million. Following an anti-dumping ruling by the United States in 2003 and confusion with American species of catfish, the two Mekong species are mostly marketed abroad these days as pangasius, basa, panga or sutchi filets. According to Vu, "new export markets such as Mexico and the core markets in Europe are seen as a guarantee that catfish production will continue its growth as previewed."

Choose a newsletter: